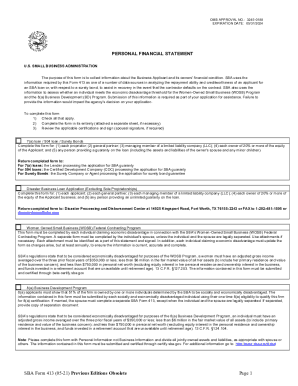

Who needs a Form SBA 413?

SBA Form 413 — the Personal Financial Statement is needed for SBA loan applicants to provide information on loan eligibility based on their own and their spouse’s personal net worth. This form is useful to those who apply for the following types of loans:

- 7(a) loans to the lender processing the SBA application;

504 loans to the Certified Development Company processing the SBA application;

ALL Disaster loans to the Disaster Processing and Disbursement Center at 14925 Kingsport Road, Fort Worth, TX 76155-2243; and

8(a)/BD — applicants and their spouses who are claiming socially and economically disadvantaged status.

This form should be completed for: 1) every business owner, 2) general partner, 3) managing member of an LLC, 4) each owner of 20% or more of the equity of the applicant (including the assets of the owner’s spouse and any minor children); and 5) any person providing the guarantee on the loan.

What is Form SBA 413 for?

Form SBA 413 provides comprehensive information on the financial status of the applicant. The form consists of three pages. The first provides information on the applicant’s assets and liabilities, the following two concretize and broaden the information submitted on the first page of the document.

Is Form SBA 413 accompanied by other forms?

You should note that filing this form requires gathering a vast number of supporting documents. To complete a fillable SBA 413 form you should provide the following documents:

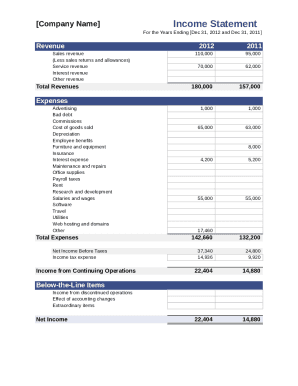

List of Assets:

- Ownership records for cars, houses and other significant personal possessions;

Current balance statements (account statements, monthly statements, etc.) confirming dollar amounts that you specify in the form. The information must be relevant and related to the period of the last month;

Proof of the current value of assets (appraisals, county tax assessments, etc.) for every house, car or substantial property.

Liabilities:

- Loan and mortgage statements of any kind (car, house, boat, etc.) including a current balance statement showing balance owed;

Credit card statements including information on the credit card, even if it indicates a zero balance;

Notes payable to banks such as HELOT, 2nd mortgage, student loans, personal loans, shareholder/member loans, etc.

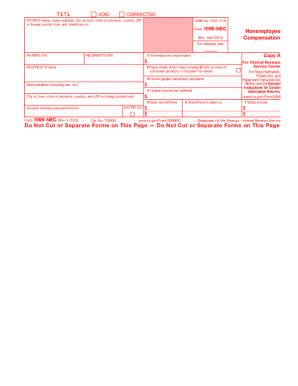

Sources of income:

- The amount of your current annual salary;

The sum of net investment income, which you can get in the current year;

The sum of all income from private property that you own for the current year;

The amount of any other income. For example, disability benefits, awards, and scholarships.

How do I fill out Form SBA 413?

Pay attention to the expiration date specified in the upper right corner of the form. The SBA 413 form must comply with this expiration date.

The “As of” Date’’ field indicates the specified due date for the information provided. Usually, this date should be the last day of the previous month.

You should provide your personal information and specify the following points:

- On your assets: 1) cash on hand & in banks 2) savings accounts 3) IRA and other retirement accounts 4) accounts & notes receivable 5) life insurance — cash surrender value only 6) stocks and bonds 7) real estate 8) automobiles

On your liabilities: 1) accounts payable 2) notes payable to banks and others 3) installment account (auto and other) 4) loans on life insurance 5) mortgages on real estate 6) unpaid taxes

Once you have finished filling the form, you should sign it and place SBA 413 with other documents into one envelope. Now your SBA 413 form is ready to be sent.

Where do I send Form SBA 413?

There are two mailing addresses depending on the state in which your firm is located. The first page of the filler’s SBA 413 form gives a list of states and specifies the address where you should send the completed form.